The Ultimate Wood Heat

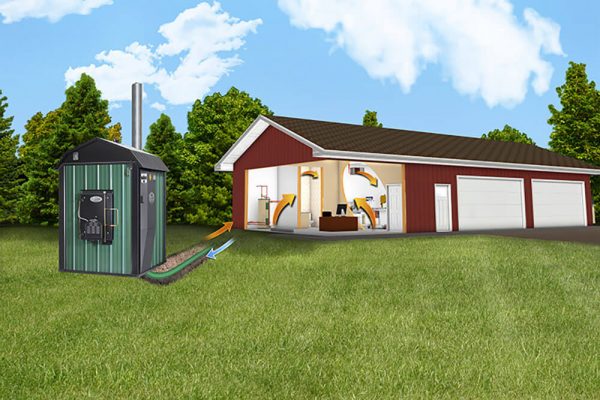

THE BEST OUTDOOR WOOD FURNACE EVER MADE

Classic Edge Titanium HDX outdoor wood furnaces are the most efficient outdoor wood furnace that meets the stringent EPA Step 2 Certified requirements. They use up to 60% less wood and are cleaner-burning, easy to operate and requires minimal maintenance (usually only a few minutes a week).

The titanium-enhanced stainless steel firebox ensures zero corrosion inside the firebox and is designed to last a lifetime. With features like Coal Bed Saver and the Burning Time Monitor, you can burn any kind of firewood.

MyFireStar.com

The FireStar Controller with onboard Wi-Fi keeps you informed of your furnace’s performance and operation. View operational information and receive text alerts on your smartphone or computer. Watch a live demo at MyFireStar.com/demo.

All together, that makes the Classic Edge HDX outdoor wood furnace the BEST OVERALL VALUE ON THE MARKET. Check out the models page for specifications of specific Classic Edge HDX models.

High-efficiency biomass heating products qualify for a tax credit under Section 25(C) of the Internal Revenue Code (“IRC” or “tax code”). This 30 percent tax credit – capped at $2,000 – is available for appliances installed on or after January 1, 2023. Central Boiler Classic Edge 360, 560, 760, 960 HDX and Maxim M255 PE models qualify for the credit.

Homeowners that purchase and install a Classic Edge HDX or M255 PE model can claim the 30% tax credit, capped at $2,000, by using form 5695 when filing federal income taxes in the year the installation is completed.

It doesn’t matter if you pay for the furnace and installation up front or finance your purchase. Central Financing is available at participating dealers with very attractive financing options for the furnace and installation. Either way, you’re eligible for the tax credit.

A tax credit is a dollar-for-dollar reduction of the federal income tax you owe. So in order to qualify for the federal tax credit, you need to owe taxes to benefit. The Biomass Stove Tax Credit is a non-refundable personal tax credit which means it can only reduce or eliminate your liability (how much money you owe to the IRS).

The credit decreases your tax liability. (It does this by increasing your refund or, if you owe taxes, it decreases the amount you have to pay). After you’ve had your qualifying Central Boiler outdoor furnace installed, simply fill out an additional form when it’s time to file your federal income taxes. The form you’ll need to fill out for the IRS is 5695. If you have questions or need help completing the form, contact your tax professional.

Keep your purchase receipt(s), including the cost of the furnace and installation. You should also have a copy of the Manufacturer’s Certification Statement stating the the outdoor furnace qualifies for the credit and is at least 75% efficient (HHV). You can download the statement at CentralBoiler.com. You don’t need to send these with your tax return.

Both purchase and installation costs (e.g., piping and related materials, onsite labor) can be included in your total cost.

This summary information is provided as a convenience and may not be relied upon as a substitute for professional tax advice. Central Boiler, Inc. is not a tax advisor. Taxpayers claiming a tax credit should consult a tax professional with any questions. Central Boiler is not responsible or liable for the taxpayer’s ability to receive tax credits.